2025 has been a difficult year for many allocators in private equity. Reduced exit activity leading to reduced distributions, the need to meet ongoing capital calls, and the ‘denominator effect’ have all contributed to a liquidity headache for many limited partners (LPs).

This lack of liquidity has seen some LPs turn to the secondaries market to offload non-core fund positions or older vintage funds and accelerate cash returns.

New records in the Secondaries Market

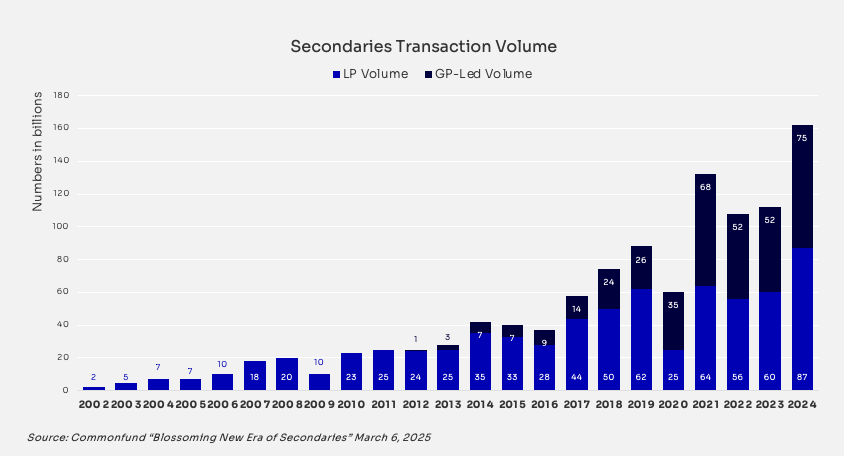

The LP-led secondaries market recorded its largest year on record in 2024 ($87 billion), representing a 45% increase from 2023 and a 36% increase over the previous record high in 2021.¹ Increasingly viewed as an important source of liquidity for LPs, 2024 secondaries volume represented approximately 20% of total global PE exit activity.² The GP-led market has shown similar growth with a record $75 billion of transaction volume in 2024, representing a 44% increase from 2023 and a 10% increase over the previous record high in 2021.³ The trend has continued into 2025. In H1 2025, the global secondaries market (LP-led and GP-led) hit ~$103 billion, up ~51% from H1 202,4 with full-year 2025 secondaries volumes on pace to exceed $120 billion.⁴

We spoke to Hugh Simpson, a Director in the Responsible Investment Group at Petra Funds Group, LLC, about how ESG considerations are reshaping secondaries transactions.

Quick Primer on Private Equity Secondaries

In a typical LP-led secondaries transaction, an LP sells its interest in one or more funds to a third-party secondary buyer. This is typically done to increase liquidity, reduce overexposure, change manager relationships, or respond to denominator effect pressures, with pricing often at a discount to NAV.

GP-led secondaries work differently. A GP creates a fund continuation vehicle, or FCV. One or more portfolio companies from an existing fund are sold into the FCV, often to give underlying assets more time to grow or manage LP liquidity needs. Existing fund LPs can sell down their positions for cash or roll into the FCV. These can take the form of single-asset FCVs, multi-asset continuations, or tender offers.

Why is ESG becoming more important in secondaries transactions?

Historically, ESG considerations played a more limited role in secondaries transactions. LP-led deals often involved mature funds and small stakes, with little opportunity for leverage or influence. The focus was primarily on valuation and liquidity, with ESG treated as a background consideration.

However, this is changing as regulation and LP mandates tighten. In today’s secondaries market, ESG is no longer just a high level review. It has evolved into a comprehensive, multi-level analysis that can materially impact transaction outcomes. Frameworks such as those developed by MSCI are increasingly being used to benchmark fund and asset-level performance, enhancing transparency and comparability across secondary transactions.

GP and LP-led transaction structures expose investors to different levels of ESG risk and influence, requiring different ESG approaches when assessing a secondaries transaction.

What does that mean practically for LP-led secondaries?

Secondaries investors in LP-led transactions take on the traditional LP role and hence their ESG focus is on the ESG practices of the GPs. This typically includes a thorough review of policies, processes, and how the GP integrates ESG across the lifecycle of an investment. LP secondaries buyers will also review the portfolio to identify risk exposures and ensure the portfolio meets the LP’s investment criteria.

At Petra, we help clients assess LP-led secondaries using our proprietary ESG Maturity Assessment methodology to score and benchmark the maturity of GPs’ ESG practices across the lifecycle of an investment (from strategy through to diligence, monitoring, engagement and exit). We also work with GPs on their ESG program strategy and implementation to ensure they pass the most discerning LPs’ ODD and ESG DD requirements.

At the portfolio level, Petra supports LPs to conduct risk exposure scoring across regional and sectoral dimensions, including climate considerations, and apply both inclusionary filters (i.e., fund goals, SFDR eligibility, and side letter criteria) and exclusionary screens.

How does this play out differently in GP-led secondaries?

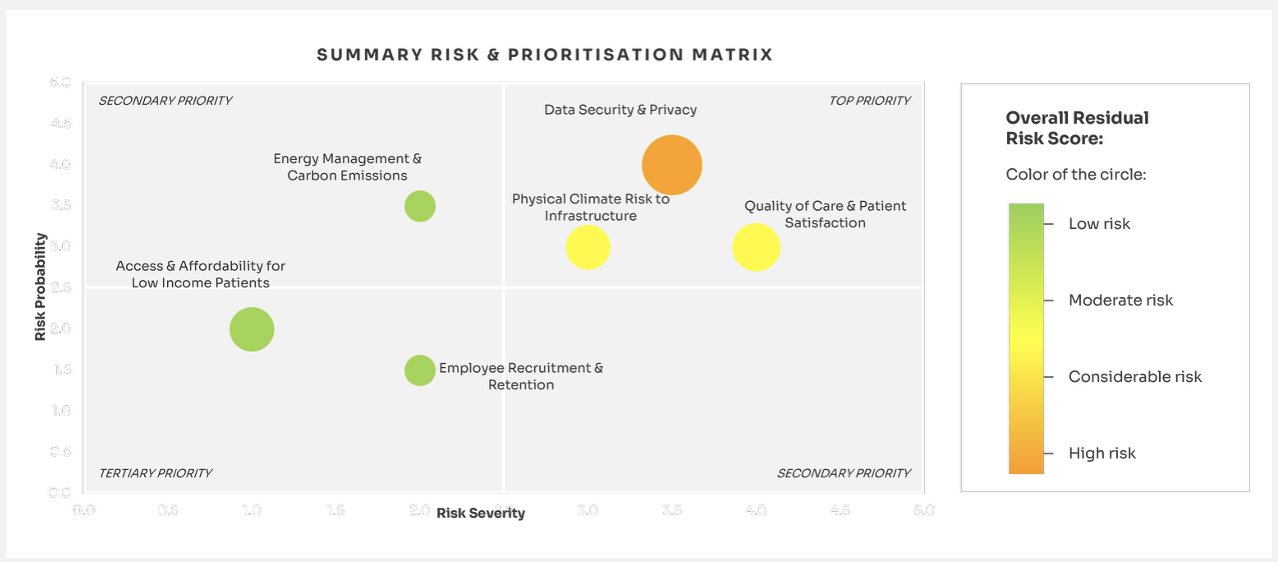

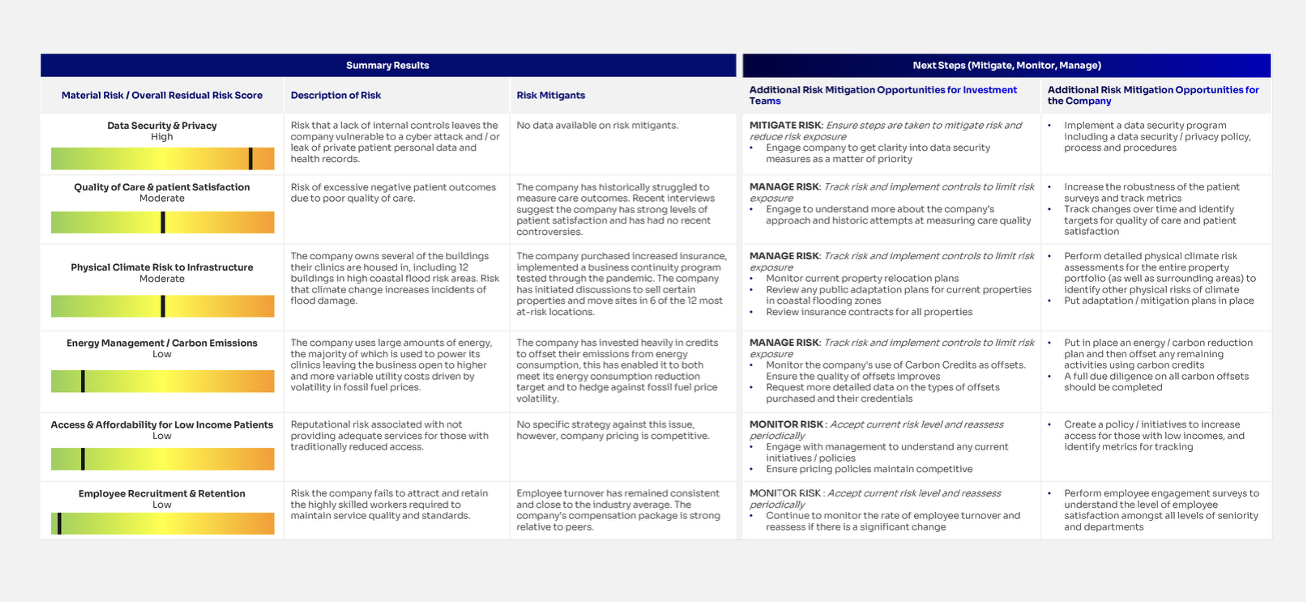

GP-led deals offer additional opportunities for ESG integration due to greater access to the underlying asset(s). These types of transactions usually involve a single or more concentrated set of assets. Therefore, investors’ ESG focus should be on the underlying investments. This includes identifying and assessing the investment-specific material ESG risks and opportunities.

When a GP moves assets into an FCV, there is not only the ability to carry out more thorough diligence but also an opportunity to reset previous initiatives that may have stalled or been deprioritized in the original fund structure. These transactions can support long term value additive ESG initiatives that need 3 to 5 years to show returns (e.g. energy efficiency improvements that could not be completed in the original fund term).

At Petra, we assess the underlying assets of a GP-led secondaries transaction using our comprehensive ESG Diligence methodology. We identify the business model-specific ESG issues for each investment and assess the overall risk exposure for the investor. This includes any progress on ESG goals or impact objectives, and how the investment aligns to regulatory requirements (e.g., SFDR, EU Taxonomy, etc.).

Petra’s multi-factor forward looking approach to ESG Diligence helps identify value protection and creation opportunities

Conclusion: A Strategic ESG Opportunity

ESG integration within secondaries has evolved. Leading LPs understand that ESG is linked to more efficient, resilient companies, with higher exit multiples. Done correctly, ESG in secondaries represents a significant opportunity, not only for driving systematic change across the private equity landscape but also for realizing tangible ESG outcomes within individual portfolio companies through continuation vehicles. As ESG data coverage and quality improve — aided by leading analytics providers such as MSCI — the secondary market is poised to achieve even greater alignment between sustainability and financial performance.

Sources:

(1)Jefferies Private Capital Advisory, Global Secondary Market Review (January 2025)

(2) Pitchbook, 2024 Annual Global PE First Look

(3) Jefferies Private Capital Advisory, Global Secondary Market Review (January 2025)

(4) Jefferies H1 2025 Global Secondary Market Review (July 2025)